How Monzo is improving the experience for vulnerable customers

Written by Robyn Jones

We’re continuing to delve into the challenges faced by vulnerable customers when dealing with utilities and financial services providers - and we’ve stumbled upon a simple, but brilliant initiative.

We’re in no way affiliated with Monzo, but we love experiences that make people’s lives that little bit easier and we think this one deserves some recognition.

In our interview with Mark McElvanney at StepChange Debt charity, we heard about the challenges surrounding engagement between financial services companies and customers in need of help.

“Even where companies are able to offer real support, they’re just not able to connect with the customer,” Mark said.

Mark went on to describe how the often narrow channels from which customers can seek help through, can further hinder engagement: “Everything is geared around picking up the phone.”

For some people dealing with financial difficulties, having to discuss their situation with another person can be a difficult proposition.

It brings even greater challenges to people dealing with multiple vulnerabilities – like those who also have a speech or hearing impairment.

Monzo is of course a digital bank, and so its interactions with customers are geared around digital – largely through its app.

But with four out of ten people in the UK regularly using mobile banking apps to access their account, banks would do well to take some inspiration here.

What have Monzo done?

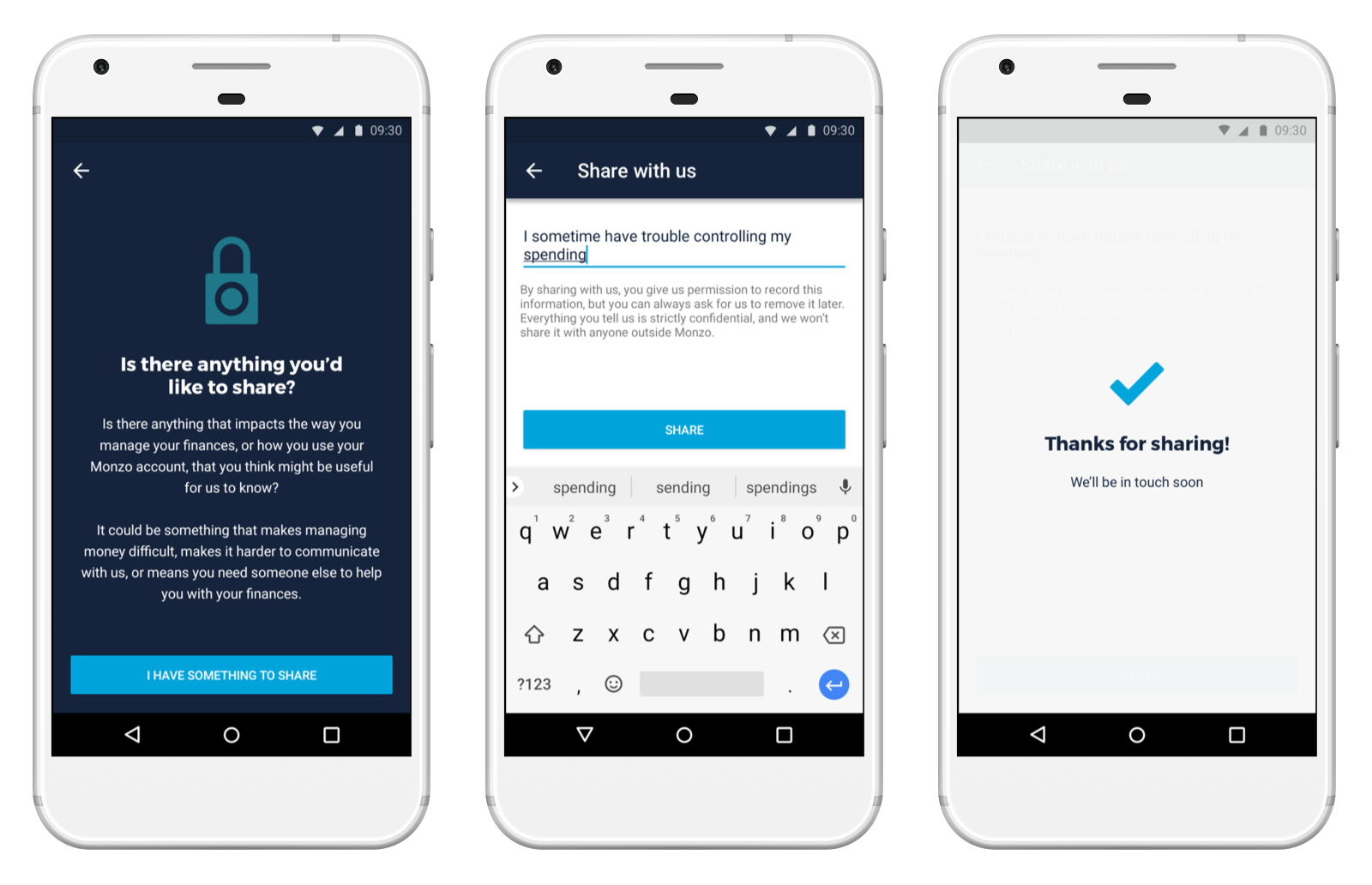

Monzo have been working with the Money Advice Trust and the University of Bristol’s Personal Finance Research Centre to develop a tool that lets customers tell them about their circumstances from the Help tab in their Monzo app.

It says it can use that knowledge to support customers in a way that suits their needs.

How it works

To share something with Monzo:

- You head to the Help section in the app

- Type ‘Share with us’ into the search bar and the option will appear

- Tell Monzo about your situation in as much detail as you’d like

They then send the information straight to their Vulnerable Customers team.

Monzo says, “Nobody understands the support you need like you do, so we’ll take your lead and listen to what you’d like us to do.

“If it’s appropriate, we’ll reach out to you through in-app chat to tell you the options available. And together we’ll decide how we can support you with your situation.”

Example scenarios

Customer situation: “I have accessibility needs”

How Monzo says it might help: “We want everyone to be able to use Monzo to manage their money, so if you have a disability or other accessibility needs, you can choose to let us know.

“For example, if you find it easier to talk over the phone, we’ll give you a call instead of reaching out through in-app chat.”

Customer situation: “I’m a compulsive gambler and I’ve chosen to self-exclude”

How Monzo says it might help: “If you’ve chosen to stop gambling, we can help you block gambling spending from your Monzo account. You can also let us know what extra support you need.

“For example, if you’re using cash to gamble, you might want us to reduce the limit on the amount of cash you can withdraw in a day, or point you towards free sources of support and advice.”

Customer situation: “My health’s affecting the way I manage my money”

How Monzo says it might help: “Changes to your health can have an impact on the way you manage your money.

“If something’s affecting your ability to make decisions, we can turn off your overdraft so you don’t get into debt you can’t manage, or add a bit of friction by removing the option to open an overdraft from your app, so you have to speak to customer support before we lend to you.

“Or if you’re struggling with your mental health while you’re in your overdraft, we can give you some ‘breathing space’ so you have time to focus on your recovery.”

Monzo believes this will help make it a more accessible, responsible product for everyone.

It says it will use the feedback, experiences and information that customers share to design new product features (or change existing ones) to help other people in similar situations.

Frankly, we think it’s brilliant.

What else is going on

-

March 2024

Ghost Spam in GA4 – How to Spot and Deal With It

How to spot and deal with ghost spam in Google Analytics 4 (GA4) to safeguard your data insights. Implement proactive measures to maintain data accuracy.

-

November 2023

Mando to bridge skills gap at BIMA Digital Day

The BIMA Digital Day on November 8th is an attempt to bridge this skills gap, as eight of Mando's experts will spend time with around 240 Year 10 students from The Studio School at their Liverpool campus.